The Great Labor Market Restructuring of 2026: January Signals for Tech, Retail & Crypto Workers

January 2026 Summary: 78,000 UPS cuts, 80% crypto hiring collapse, and Amazon's hierarchy flattening reveal which sectors are hiring—and which are disappearing.

January 2026 Revealed Your Sector's Future

Companies aren't trimming costs. They're eliminating entire organizational layers and restructuring business models.

January 2026 by the numbers:

- Crypto hiring collapse: ↓80% (1,192 jobs/week → 85 jobs/week)

- UPS job cuts (18 months): 78,000 positions eliminated

- Amazon corporate layoffs: 14,000+ (10% of white-collar workforce)

- UK retail losses (2025): 201,953 jobs lost

- Tech mega-cuts: 36,000+ across Amazon, Microsoft, Meta

Three forces reshaping work:

- Profitability over growth – Companies prioritize margins over headcount

- Automation over human labor – AI efficiency accelerates workforce reductions

- Experience over entry-level – Senior roles surge while junior positions vanish

The January Mega-Layoffs: What Each Signal Reveals

UPS: 78,000 Jobs Eliminated as Amazon Partnership Crumbles

UPS announced 30,000 additional cuts on January 27 (following 48,000 in 2025), closing 24 facilities by mid-2026 while delivering 50% fewer Amazon packages.

What this signals: When your largest customer becomes your competitor, entire business units become obsolete. This is structural collapse, not cyclical adjustment.

Amazon: 14,000+ Corporate Cuts While Flattening Hierarchies

Amazon eliminated 10% of its corporate workforce in January. CEO Andy Jassy stated the company "accumulated too many layers".

The paradox: While cutting corporate roles, Amazon continues hiring in AWS infrastructure, AI, and cloud security. Retail operations are being automated or outsourced.

Career implication: Senior IC roles increasingly replace management positions. Traditional promotion pathways are shrinking.

Microsoft Cuts 11,000-22,000 as Budgets Shift to AI

Microsoft announced layoffs spanning 11,000-22,000 employees, concentrating cuts in legacy divisions. Meta simultaneously cut 1,500+ Reality Labs positions.

Budget reallocation map:

- ✅ Gaining: AI/ML infrastructure, cloud security, data engineering, compliance automation

- ❌ Losing: Consumer VR/AR, legacy software, general marketing roles

The 80% Crypto Hiring Collapse: Your 4-Week Warning System

From 1,192 Weekly Postings to 85: Understanding the Freeze-to-Layoff Cycle

Web3 job postings collapsed 80% year-over-year. Polygon Labs cut ~30% of staff post-acquisition. Only well-funded firms like Anchorage Digital (66 openings) continue recruiting.

The timeline pattern:

- Weeks 1-2: Company announces "strategic review"

- Weeks 3-4: Job postings disappear

- Weeks 5-6: Hiring freezes become internal knowledge

- Weeks 7-10: Formal layoff announcements (WARN notices)

If your company froze hiring in January, expect potential layoffs in February-March.

Two Divergent Crypto Labor Markets

Contracting roles:

- Early-stage project developers

- Junior smart contract devs

- Unfunded startup marketing/growth roles

Expanding roles (premium pay):

- Protocol economists ($200K-$400K+)

- Compliance officers

- Security/audit specialists at Binance, Anchorage, tradfi crypto divisions

Pay analysis: Experienced crypto compliance/security roles exceed FAANG compensation by 20-40%, while entry-level positions collapsed 80%.

Retail: 201,953 Jobs Lost in 2025 = Structural Extinction

UK retail lost 201,953 jobs in 2025, with 17,349 store closures driving employment to a record low of 2.8 million.

Three converging forces:

- Rising labor costs (minimum wage, payroll taxes)

- E-commerce migration (in-store shopping declining)

- Consumer spending weakness (cost-of-living pressures)

Reskilling pathway: Retail workers should prioritize e-commerce logistics tech, warehouse automation, or last-mile delivery operations—sectors absorbing retail's displaced volume.

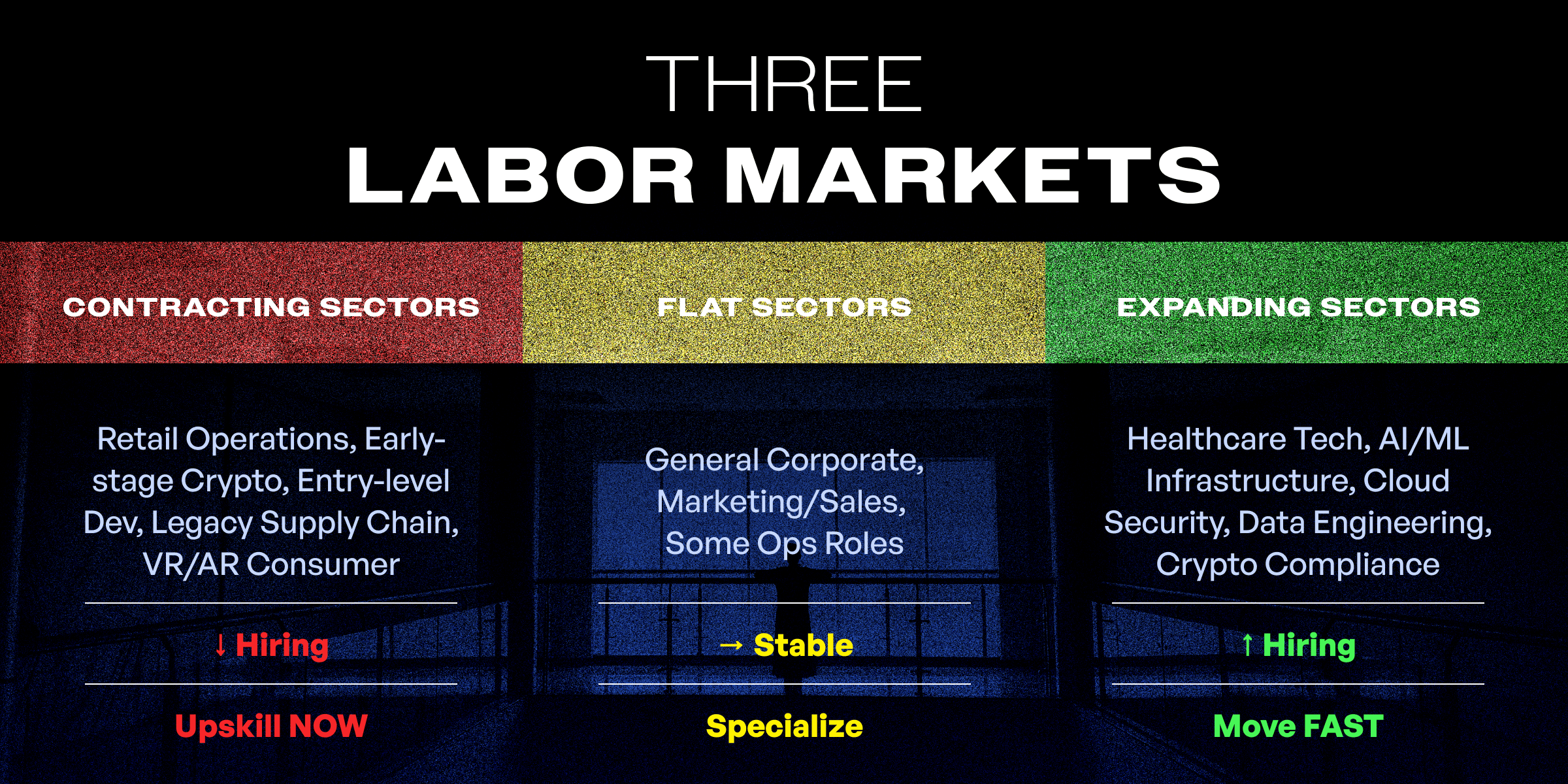

The Three Labor Markets of 2026: Which Are You In?

🔴 Contracting Sectors (Job Losses Accelerating)

- Entry-level/junior roles across industries

- Physical retail operations

- Early-stage crypto/consumer Web3

- Legacy supply chain operations

- Consumer VR/AR hardware

- Middle management layers

Your move: Upskill into growth sectors while employed (4-8 week timeline). Don't wait for layoffs—12+ month job searches are possible.

🟡 Flat Sectors (High Competition, Limited Growth)

- General corporate administrative roles

- Traditional marketing/sales (non-specialized)

- Standard operations without technical depth

- Mid-level management in non-growth industries

Your move: Deep specialization beats generalist positioning. Add technical skills (SQL, Python, data analysis). Expect 3-6 month job searches.

🟢 Expanding Sectors (Talent Shortages)

- Healthcare technology

- AI/ML infrastructure

- Cloud security/enterprise cybersecurity

- Data engineering

- Crypto compliance/security (established firms)

- Supply chain technology/logistics automation

Your move: Move fast—roles fill in 2-3 weeks. Use crypto/infrastructure salary benchmarks in negotiations. Expect 20-35% compensation premiums.

Entry-Level: The Longest Job Search Drought in 5 Years

Companies eliminated junior roles through AI automation, hierarchy flattening, and prioritizing experienced specialists (30-40% pay premium over training juniors).

Entry-level strategies:

- Portfolio over resume – Demonstrate capabilities through projects

- Infrastructure over consumer – Target B2B companies with steadier growth

- Geographic flexibility – Some markets remain tighter than others

- Timeline realism – Expect 6-12 month searches

- Alternative pathways – Internships, contract-to-hire, open-source contributions

February 2026 Predictive Framework

Testing January's Analysis With Observable Signals

If this analysis is accurate, these events should occur:

Week of Feb 3-7:

- First crypto layoff wave (following January freezes)

- Additional retail WARN notices

- Amazon/Microsoft second-phase announcements

Week of Feb 10-14:

- Tech hiring freezes become public

- Crypto postings stay below 90/week

- Supply chain tech deals announced

Week of Feb 17-21:

- Retail closures accelerate

- Job postings drop 15-25% in contracting sectors

- Salary increases in cloud, security, data roles

Validation by Feb 28: If 75%+ predictions occur, this represents structural change requiring strategic adaptation. Return to evaluate accuracy.

Strategic Action Plans by Position

Contracting Sector Workers

- Update resume immediately (while employed)

- Identify 2-3 target growth-sector roles

- Allocate 5-10 hours/week for skill-building (4-8 weeks)

- Network proactively in target sectors

- Document accomplishments before potential layoffs

Flat Sector Professionals

- Develop one high-value specialization

- Add technical capabilities (SQL, Python, analytics)

- Prepare for 3-6 month timelines

- Prioritize remote-friendly roles (RTO mandates increasing)

- Frame experience for growth-sector transitions

Expanding Sector Candidates

- Act within 2-3 weeks (windows close fast)

- Negotiate using crypto/infrastructure benchmarks

- Evaluate company fundamentals beyond growth narratives

- Build complementary skills (Python + SQL for data roles)

- Expect compressed onboarding with steep learning curves

Entry-Level Job Seekers

- Build portfolio demonstrating capabilities (8-12 weeks)

- Target B2B infrastructure over consumer tech

- Consider alternative entry points (open-source, equity-for-work, contract-to-hire)

- Stay geographically flexible

- Plan finances for 6-12 month searches

January 2026 Layoff Summary

| Company | Cuts | Primary Reason | Date | | --- | --- | --- | --- | | UPS | 30,000 | Amazon partnership reduction | Jan 27 | | Amazon | 14,000+ | Hierarchy flattening | Jan 27 | | Microsoft | 11,000-22,000 | Cloud + AI reallocation | Jan 2026 | | Meta | 1,500+ | Reality Labs pause | Jan 13 | | Ericsson | 1,600 | 5G slowdown | Jan 15 | | Capgemini | 2,400 | IT restructuring | Jan 2026 | | ASDA | 1,200 | Warehouse outsourcing | Jan 2026 | | Citigroup | ~1,000 | Restructuring | Jan 2026 | | Polygon Labs | ~30% | Post-acquisition | Jan 2026 |

Total: 68,000+ announced (excludes silent restructuring)

Key Metrics to Monitor

- Crypto collapse: 85-90 jobs/week vs 1,192 last year = 80% drop

- Retail losses: 201,953 jobs (2025) = structural not cyclical

- UPS cuts: 78,000 jobs (18 months) = partnership model broken

- Amazon corporate: 14,000 cuts (10% workforce)

- Compensation bifurcation: Experienced specialists earn 30-50% premiums; entry-level positions down 80%

The January 2026 Blueprint

Core thesis: Companies signaled capital allocation in January. Your career strategy should align with these signals, not hope for reversals.

Three permanent changes:

- Your sector's 2026-27 trajectory was established in January

- Hiring freezes predict layoffs 4-6 weeks later

- Experience bifurcation is structural—career ladders are broken

Your strategic move:

- Contracting sector? Cross-train now (4-8 weeks)

- Flat sector? Specialize deeply (not generalist)

- Expanding sector? Move fast (2-3 week windows), negotiate hard

- Entry-level? Build portfolio (6-12 month timeline)

Join the Labor Market Intelligence Community

📢 Real-Time Job Alerts & Hiring Signals:

Hyphen-Connect Announcements Channel

💬 Web3 & AI Professional Community:

Apply for Private Channel

Disclaimer

The information in this post is for educational purposes only and does not constitute professional career, legal, or financial advice. While we strive for accuracy using publicly available data as of February 2026, labor market conditions change rapidly. Individual career outcomes vary significantly based on personal circumstances, qualifications, and market factors. We make no guarantees about the accuracy, completeness, or applicability of this information to your specific situation. Predictions about future labor market trends are inherently uncertain. Any reliance on this content is at your own risk.