Hyphen Pulse: October 2025 — AI Talent Tilts to Emerging Markets; Web3 Hiring Rebounds

Executive Summary

The global tech hiring map rebalanced in 2025. Industries most exposed to AI have grown revenue per employee ~3× faster (27% vs 9%, 2018–2024), even as total job postings fell ~11% YoY; roles requiring AI skills still rose ~7.5%. Randomized evidence shows hybrid work doesn’t hurt performance and reduces attrition by about one-third. Early-stage teams are leaner and more capital-efficient, with Series-A funding >$320k per employee (median) in 2025. Meanwhile, Web3 employment rebounded ~47% (66,494 new roles), clustering around security, smart-contract/Rust, and compliance. Persistent regional compensation gaps enable quality-controlled cross-border hiring where it fits strategy.

Global Talent Signals

Productivity & postings. AI-exposed industries posted ~27% revenue/employee growth from 2018 to 2024 (vs ~9% for least-exposed). At the same time, overall postings fell ~11.3% YoY while AI-skill postings still grew ~7.5%—a shift from broad hiring to AI-intensive roles.

Work models. A large randomized controlled trial shows hybrid work reduced quits ~33% with no measurable performance penalty, and managers’ views of hybrid productivity improved after the experiment.

Capital efficiency. Early-stage companies are raising more per employee and hiring more selectively: Series-A rounds now exceed $320k per employee (2025 median) in the U.S. tech sample.

Web3 rebound. 66,494 Web3 roles were added in 2025 (+47% YoY); remote roles reached 26,925 (+40% YoY). Regional totals: North America >23k; Asia 10,420; Europe 10,263; LATAM 1,097 from a smaller base.

Regional Deep Dives

🇮🇳 India — AI at scale

Ninety-three percent of Indian business leaders plan to deploy AI agents within 12–18 months (Work Trend Index 2025). India already counts ~420,000 employees in AI roles, with demand projected to accelerate through 2026. Implication: Enterprise-grade adoption + deep services talent make India the anchor of “strategic remote.”

🇧🇷 Brazil — GenAI momentum

LinkedIn Talent Insights summarized by INSEAD shows 110,000+ professionals in Brazil listing GenAI skills, leading LATAM. Implication: Strong fintech and applied-AI ecosystems are expanding the practitioner pool.

🌏 Southeast Asia — Web3 & infra hubs

Asia accounted for 10,420 of 2025’s Web3 roles, with finance and protocol teams clustering in regional hubs. Competitive comp levels and cross-border operating familiarity continue to attract crypto-fintech and infra work. Singapore, Manila, and Bangkok are frequent anchors.

🕌 MENA — Policy-driven acceleration

Saudi Arabia announced US$14.9B in AI/tech investments at LEAP 2025, underscoring government-led scale-up. Separately, UAE’s AI contribution is projected at ~13–14% of GDP by 2030, among the highest global shares. Implication: Policy → pipelines for AI & data roles.

🇵🇱 Eastern Europe — Strategic remote base

Benchmarks put CEE contractor rates commonly in the ~$45–$70/hr range (role/seniority vary), with deep pools in infra, security, and protocol engineering—delivering a strong quality-to-cost ratio for specialized teams.

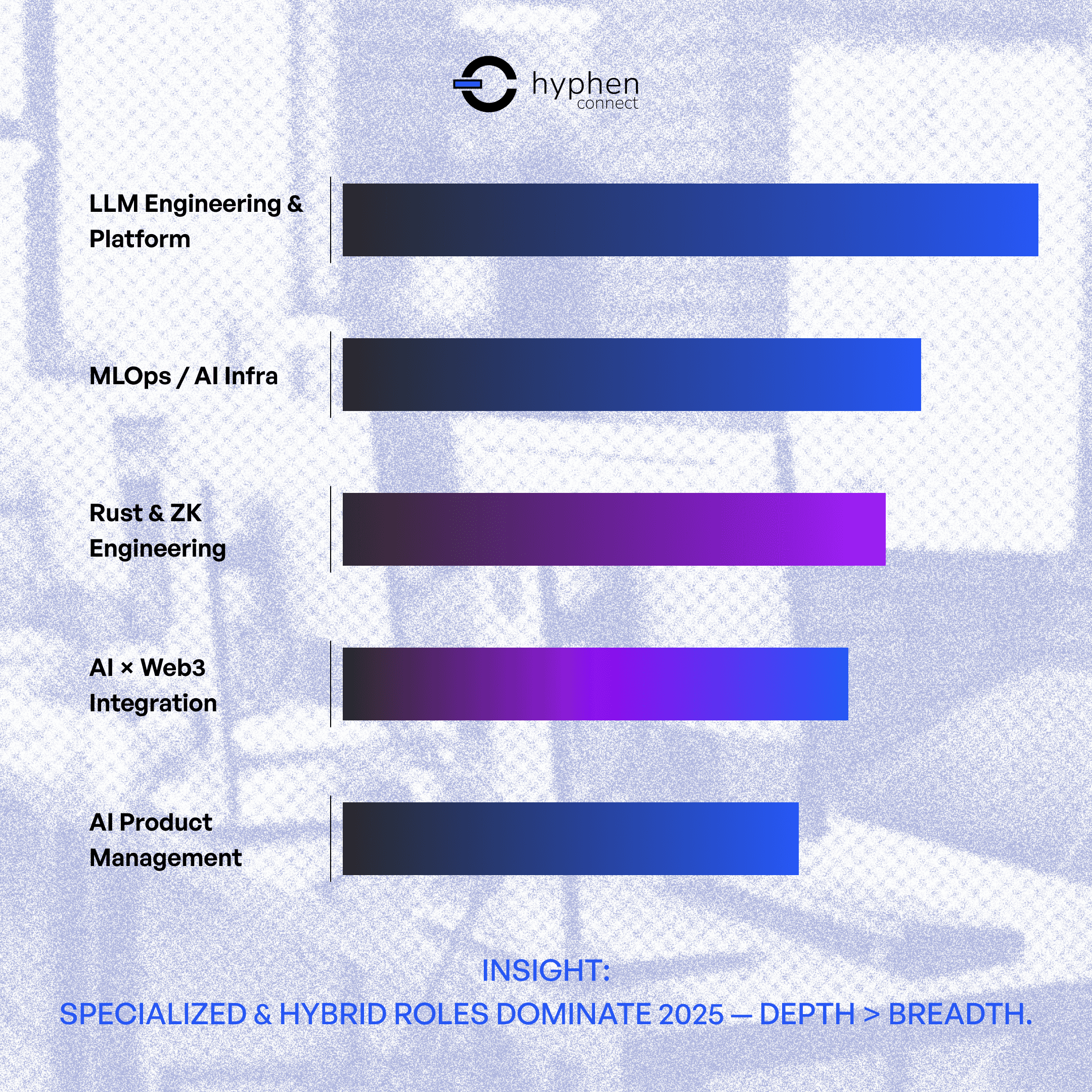

Skill Radar (what’s rising, evolving, stabilizing)

Rising: LLM engineering & platform; MLOps/AI infra; Rust & ZK; AI×Web3 integration; AI product.

Evolving: Data roles unbundle (ML Eng, MLOps, Analytics Eng); AI ethics embedded into product/eng.

Stabilizing: NFT-specific roles have leveled; AI-integrated full-stack rising.

Case Study Spotlight — Hailstone Labs (Web3 Incubator)

Regions: HK · VN · US · PH · TW · CN · IN

Challenge: Rapid headcount growth with low efficiency; no review cycles; misaligned teams.

Hyphen Approach: Built a remote-first team across seven markets, implemented HR architecture, and balanced tech/non-tech/GTM hiring.

Results: Time-to-hire ~2.5 months → 14–21 days; headcount 75 → 20 → 40 with higher output; venture model refined (Venture Studio → Incubator); standardized processes increased retention and cross-hub collaboration.

Impact: This shows how team design > team size: structure, cadence, and targeted hiring outperform “growth at all costs.”

Market Insight

“The hiring playbook for high-growth startups is being rewritten. In 2025, founders are trading headcount expansion for precision hiring—smaller, sharper, global teams built for speed and structure. When you can hire anywhere, the advantage isn’t volume—it’s alignment.”

— Hoven Cheung, Founder @ Hyphen Connect

Why now: AI-exposed sectors show 27% revenue/employee growth (2018–2024) while total postings declined ~11% YoY; hybrid reduces quits ~33% without hurting performance; Web3 roles rebounded +47%.

The era of “growth at all costs” is over. In 2025, teams win by design, not size.

Hyphen Connect helps AI & Web3 companies build strategic, distributed teams that perform globally from day one.

🌏 Connect: https://linktr.ee/hyphenconnect

Disclaimer

Disclaimer. This publication is provided by Hyphen Connect for general information only. It does not constitute legal, tax, accounting, investment, employment, or other professional advice and should not be relied upon as such. While we use third-party sources we believe to be reliable, we do not warrant the accuracy, completeness, timeliness, or fitness of any data, estimates, or opinions. Figures (including salaries, rates, hiring volumes, and productivity metrics) are illustrative, subject to change, and may vary by role, market, and time. Any forward-looking statements are based on current assumptions and are not guarantees of future outcomes. Nothing herein is an offer of employment, a solicitation to hire, or a promise of results. Hyphen Connect disclaims all warranties and, to the fullest extent permitted by law, will not be liable for any loss or damages arising from use of or reliance on this content. Third-party trademarks and logos are the property of their respective owners and are used for identification only.